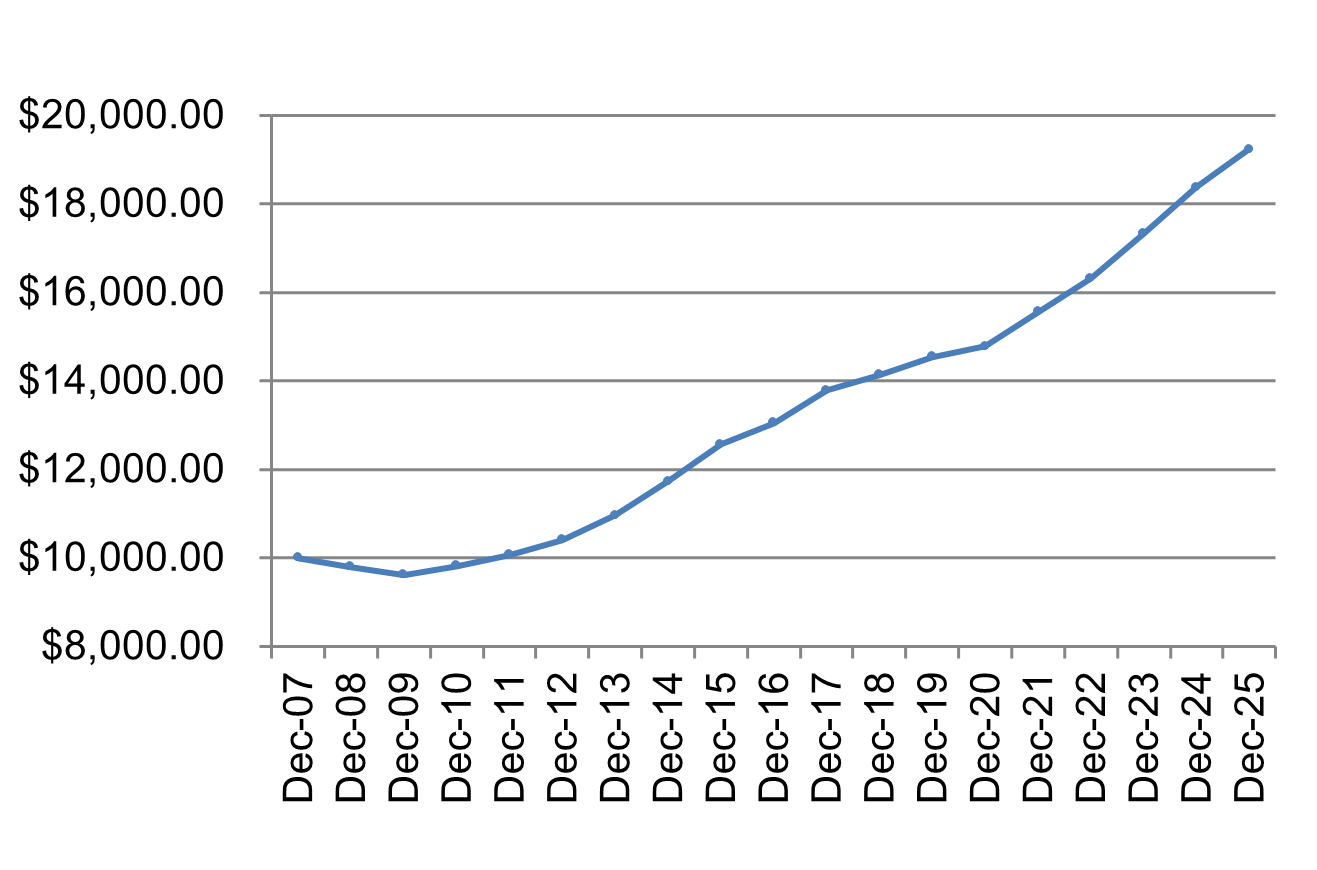

- Investment Objective: CFAL Balanced Fund, Ltd. (“the Fund”) seeks to achieve diversified above-average risk adjusted returns consistent with the Fund’s risk tolerance.

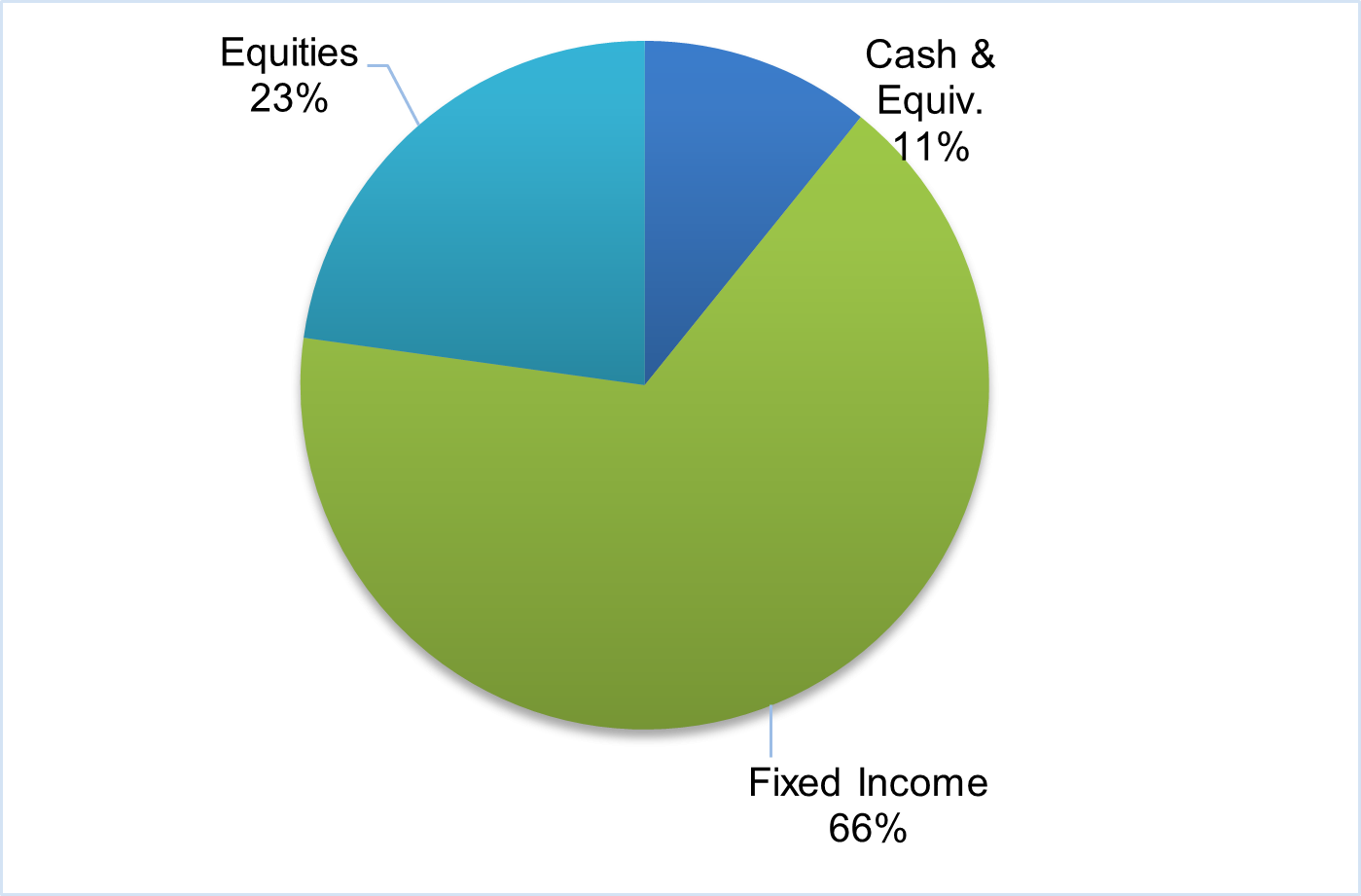

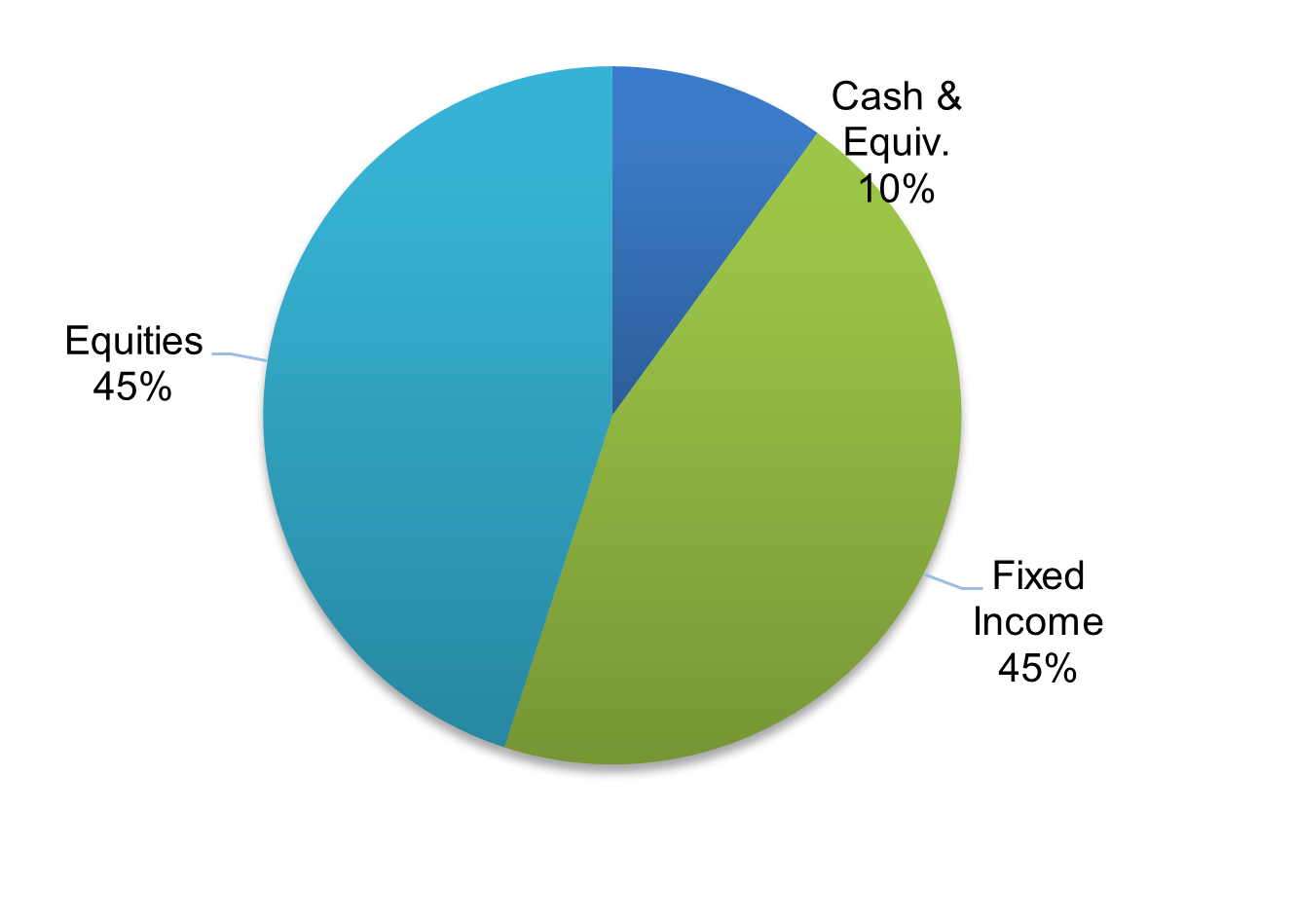

- Investment Strategy: The Fund will pursue its objective by investing primarily in a blend of equities which possess strong long-term value and growth and high-quality fixed income securities. These investments may include common stock, preference shares corporate and government bonds and cash equivalents.

- Fund Suitability: This strategy is for long-term investors who seek the highest total return (income & capital appreciation).

For a better experience on CFAL, update your browser.

For a better experience on CFAL, update your browser.