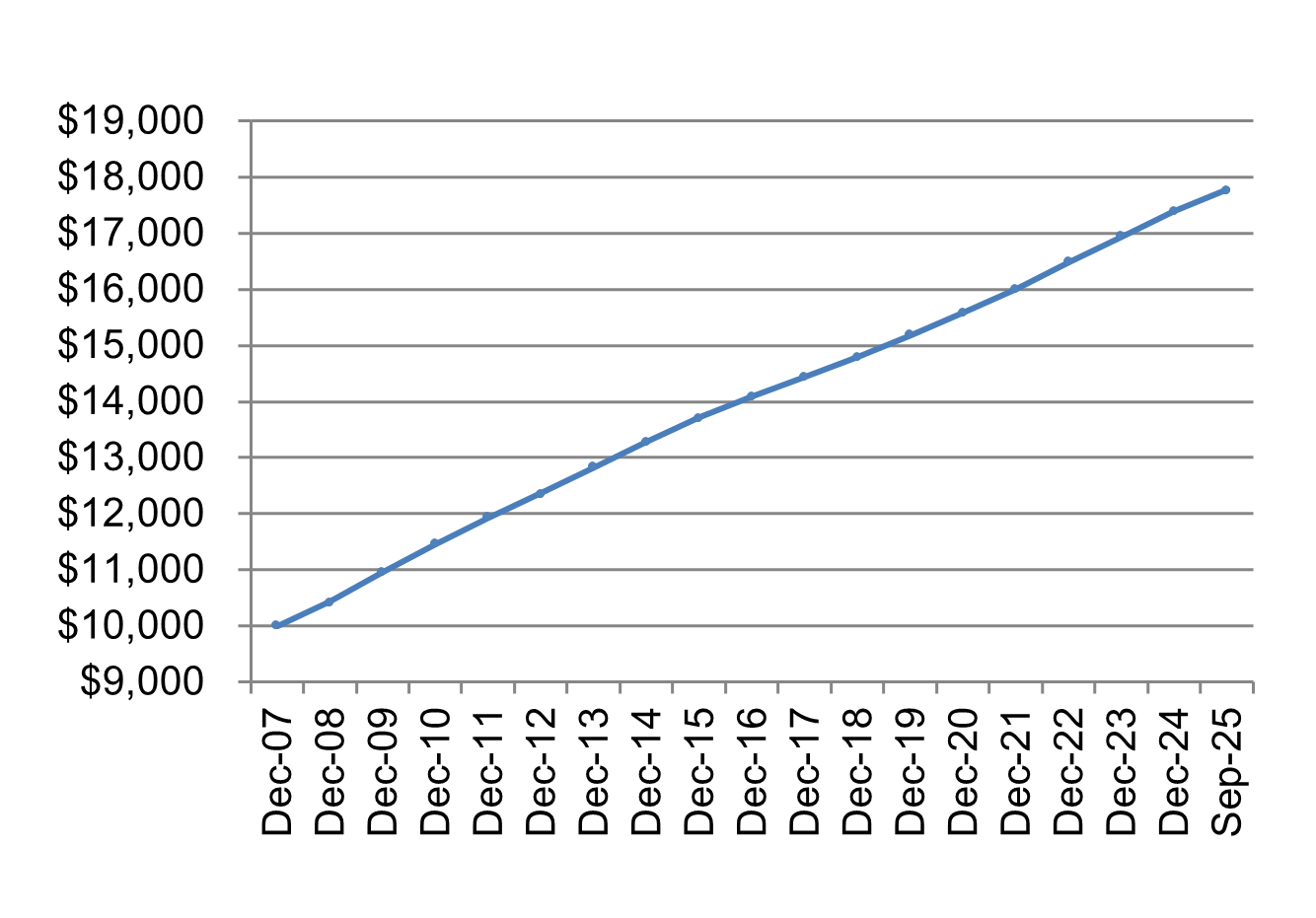

- Investment Objective: CFAL Money Market Investment Fund, Ltd. (The Fund) seeks to provide investors with a return consistent with safety of principal and maintenance of liquidity, while simultaneously providing a return competitive to local commercial bank fixed deposit rates.

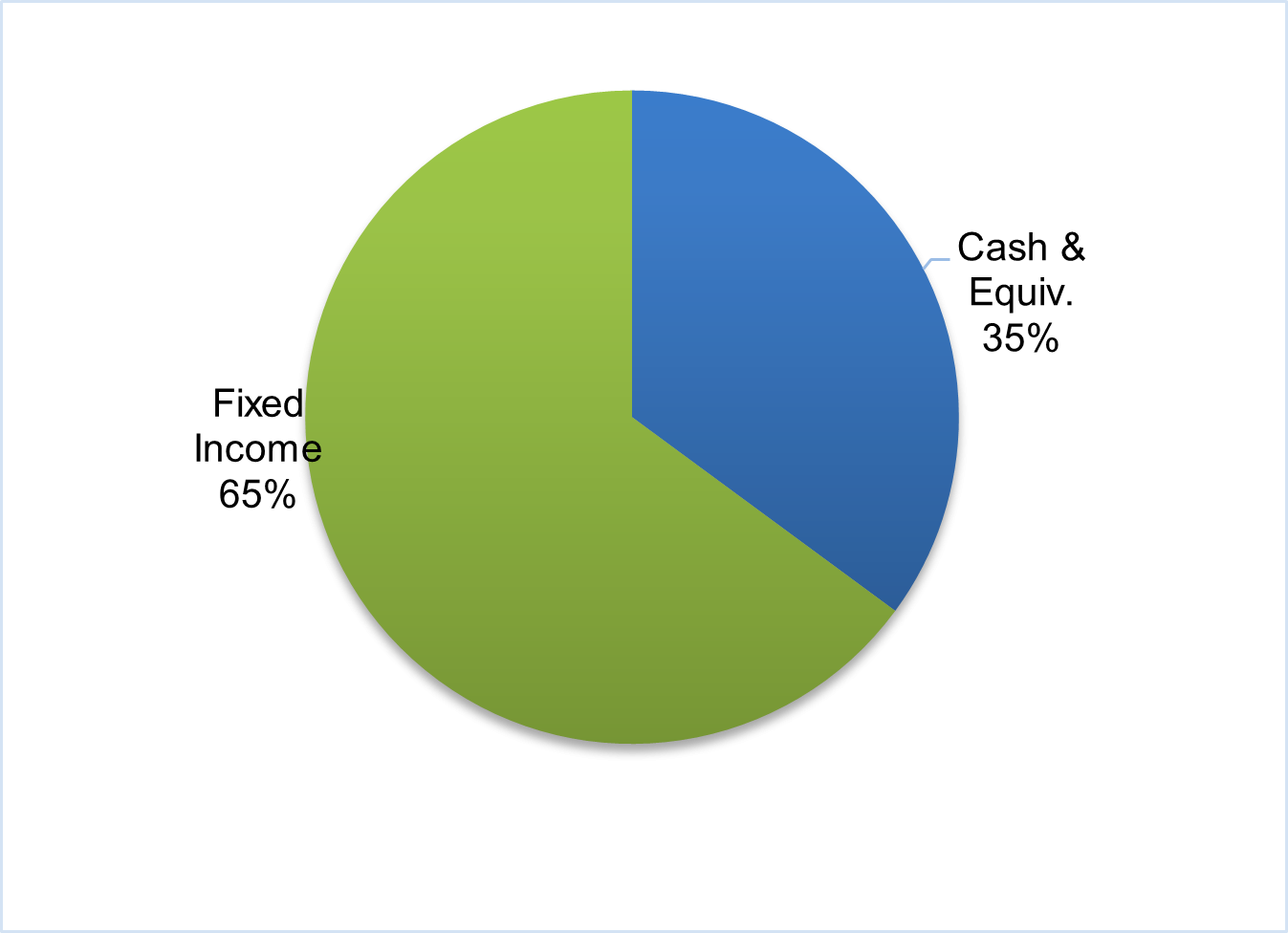

- Investment Strategy: The Fund will seek to achieve its objective by investing in fixed income securities with an attractive total return without undue risk to principal. This strategy is designed for investors seeking attractive returns over a short horizon.

- Fund Suitability: This strategy is suitable for ultra-conservative investors seeking attractive returns over a short horizon.

For a better experience on CFAL, update your browser.

For a better experience on CFAL, update your browser.